Published Oct 7, 2021

This excerpt is part of a longer Aite-Novarica Group syndicated research report and is provided compliments of Nium.

Introduction

Fintech startups have been successfully cutting into legacy players’ turf for more than a decade at this point. One reason for this success is fintech startups’ plug-and-play capabilities, which allow financial institutions (FIs) and corporate organizations to go to market quickly and begin providing better customer experiences almost immediately.

In this edition of the Retail Banking and Payments Fintech Spotlight, Aite-Novarica features seven vendors providing banking-as-a-service (BaaS), payments-as-a-service (PaaS), and even remittances-as-a-service (RaaS). These services are delivered via cutting-edge cloud-based platforms that offer specialized services, including digital banking and lending services, card issuing, payments clearing, and cross-border payments, among other capabilities. These models allow licensed banks or money transmitters to integrate their services directly into other businesses’ products. In turn, those businesses are able to deploy financial services without needing to acquire licenses or build capabilities of their own.

While the vendors profiled in this report face strong competition in the market, each is having success in the market sectors served, which is why Aite-Novarica is including them in this Fintech Spotlight:

- Blend: White-label digital lending platform powering the consumer-lending processes of leading U.S. FIs and alternative lenders

- ClassWallet: Integrated payment, purchasing, and reimbursement platform providing state and local education agencies the ability to distribute funds to teachers, families, schools, and maintenance staff

- DoubleCheck Solutions: Cloud-based digital service helping FIs, consumers, and small businesses to resolve insufficient funds events and avoid fees

- Fable Fintech: Cross-border payments platform providing multi-country, multi-currency, omnichannel, Know Your Customer (KYC), and anti-money laundering (AML) compliant payments capabilities for FIs, exchange houses, and money transmitters

- FeatherPay: Healthcare payment platform offering patients flexibility in how they pay for care and allowing healthcare providers to improve revenue performance, streamline administrative operations, and reduce unpaid patient liabilities

- Movo: Digital cash payment platform supporting both fiat and cryptocurrencies in a PaaS model providing contactless payments capabilities and instant card issuance

- Nium: Modular payments platform providing businesses access to global payment services via a single API for pay ins, payouts, card issuance, and BaaS

Methodology

The Retail Banking and Payments Fintech Spotlight is a quarterly series of reports that looks at select emerging fintech vendors active in the retail banking and payments space. In an increasingly crowded vendor landscape, FIs and their clients face a growing array of choices. This Spotlight series aims to provide insight on interesting vendors that offer a strong, unique selling point and an innovative approach, either as partners or competitors. Featured vendors must be active in commerce enablement, money transfers, bill pay, personal financial management, core banking platforms, onboarding, digital banking, data management and analytics, or lending (Figure 1). They must have at least one financial services client with a solution in production and hold annual revenue of less than US$100 million. Analysts select featured fintech vendors exclusively based on their level of innovation and their interesting approaches to wider business challenges facing the retail banking and payments market from both bank and customer perspectives. No featured vendors have paid for their inclusion in this report.

How Aite-Novarica Defines Fintech

Although popularly used as shorthand to refer to young and disruptive companies in the financial services technology space, “fintech” remains an ill-defined term meaning many things to many people. In an environment in which Tier-1 global banks, multibillion-dollar legacy vendors, and early-stage startups all refer to themselves as fintech firms, terminology remains critical in understanding the market. For purposes of clarity, Aite-Novarica defines fintech providers as technology vendors and service providers that aim to improve or automate financial services delivery, potentially disrupting legacy processes and business models in financial services.

While many types of organizations can be categorized as fintech firms, the Retail Banking and Payments Fintech Spotlight is intended to provide insights and market intelligence about some of the promising firms that are delivering banking and payments capabilities in new and/or innovative ways. As such, Aite-Novarica is primarily focused on fintech startups and midsize fintech firms, as outlined in Figure 2.

Nium

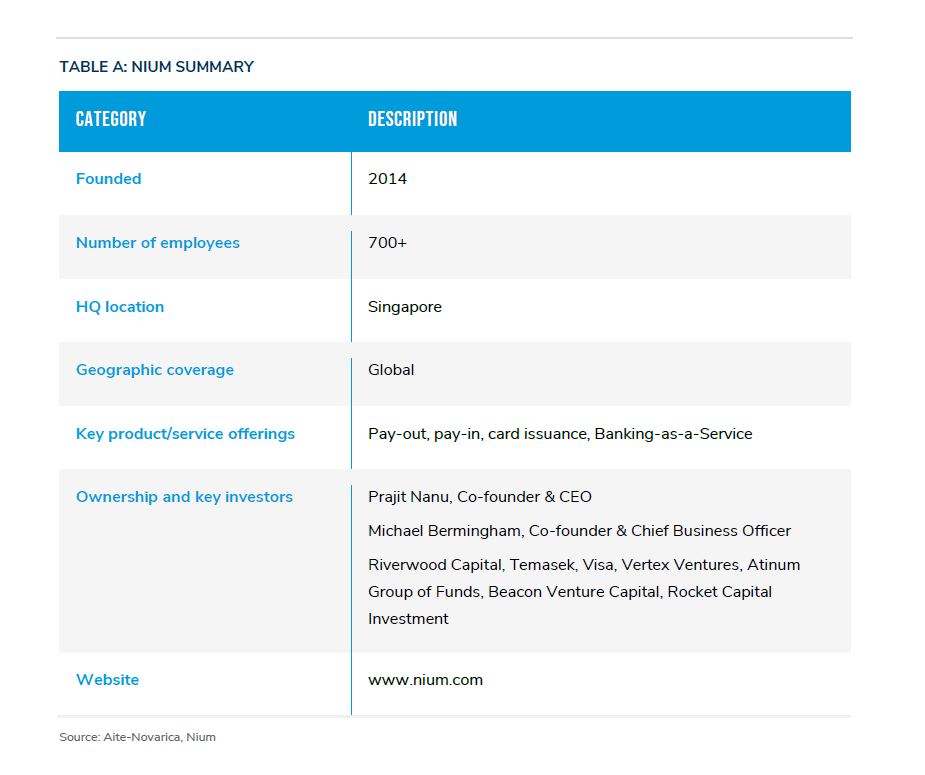

Nium, a global fintech company founded in 2014 and headquartered in Singapore, provides businesses with access to global payment services via a single API. Its modular platform provides services for pay-outs, pay-ins, card issuance, and BaaS. Summary information about Nium can be found in Table A.

Fintech pitch

Nium’s core product offering for payments and card issuance includes pay-outs, pay-ins, and card issuance. Nium also offers BaaS products—essentially, a multicurrency account with pay-out and virtual/physical card (Figure 3).

Once connected to the Nium platform, businesses have the ability to pay out in more than 100 currencies to over 190 countries, 85 of them in real time. Funds can be received in 33 markets, including Southeast Asia, the U.K., Hong Kong, Singapore, Australia, India, and the U.S. Nium’s growing card-issuance business is available in 33 countries, including the Single Euro Payment Area (SEPA) zone, the U.K., Australia, Hong Kong, and Singapore.

Core to Nium is its license infrastructure, building and owning money transfer, electronic money, and card-issuance licenses. Nium’s license portfolio covers 11 jurisdictions, enabling seamless global payments and rapid integration, regardless of geography.

Primary Target Market and Clients

Nium’s target market includes five key verticals: financial services, travel/hospitality, fintech, digital natives, and corporate clients. Its key clients include BeeTech, Frente, Ebury, Volopay, BSM, Singtel, Bank BRI, HomeSend, Travelex, Deel, Rimuut, and Accendo Banco. Table B shows Nium’s core products delivered to each of the verticals mentioned.

Key Value Proposition and Market Challenges Addressed

Businesses are increasingly embedding financial experiences to make their product offerings more compelling. With distributed customers and employees, they are also becoming more global than ever before. As companies scale, there is a need for a modern, unified payments network that can seamlessly send and receive money and issue cards across different countries. To address their customer’s needs, Nium’s key value proposition consists of three pillars:

Ease of integration: Nium connects its clients to global payments with a single API.

Network ownership: Nium has developed its own network of banking partners, licenses, and technology enablers, translating to improved customer experiences and better economics.

Modular approach: Nium offers a modular suite of payment services via its platform so that customers can mix and match pay-out, pay-in, and card issuance technologies based on their international journey.

Nium also supports is clients with its expertise in regulatory compliance (KYC, AML) and fraud monitoring. In addition, the company provides KYC-as-a-Service to its clients.

Aite-Novarica Group’s Take

Nium’s sweet spot is facilitating cross-border money movement for FIs and enterprises. With the rapidly increasing importance of cross-border commerce, businesses require easy access to global payment capabilities to reduce complexity and improve time to market. Nium’s modern cloud-based, single API-driven platform provides this. Clients can create new solutions on top of the Nium platform or white-label Nium’s solutions.

Nium’s investment in its own real-time payment network is a valuable asset that differentiates the company from the competition. Network ownership means that the company is better able to control the client experience than competitors that aggregate partner networks. With real-time payments supported in 85 countries, Nium is an attractive partner for FIs that want to extend their reach in this fast-growing segment.

With its solid funding and long track record in delivering cross-border payment solutions, Nium is well-positioned to monetize the global payments opportunity based on its modern technology stack and network capabilities. The company’s challenge will be to further build its brand and market its capabilities to compete effectively in today’s increasingly dynamic payments business.

Conclusion

- Companies want to embed financial experiences to make their product offerings more compelling. At the same time, companies are also becoming more global than ever before with distributed customers and employees. As companies scale, there is a need for a modern, unified payments network that can seamlessly send and receive money and issue cards across different countries. If FIs cannot help companies deliver these capabilities, they will look to nonbank partners to help drive strategy.

- The client experience and what clients expect in today’s payments environment are rapidly changing. While features and functionality are top of mind, up-and-coming payment platforms are increasingly specialized, offering customized and complementary solutions that cater to specific market segments and verticals, threatening legacy payment platforms’ much broader go-to-market approach.

- New models challenge old norms. Although challenger banks built on agile platforms are innovative in their approach, their products and services are still very similar to those offered by legacy card issuers. While challenger banks are more likely to provide the newest card features and functionality compared to their legacy counterparts (e.g., digital issuance and push provisioning to a mobile wallet), few can say that their product truly is differentiated in the market. As more legacy FIs catch up and support the most current innovations, only a handful of players will have a truly unique product.

- Solving for the customer experience is only part of a successful solution. Leading fintech firms are also embedding additional capabilities into their platforms to improve operational efficiency as well. For example, a cloud-based platform that supports a variety of products allows institutions to pivot nimbly in response to changing market conditions while providing a consistent look and feel.

- Fintech partnerships can enable FIs to bring new products and services to market, driving deeper customer engagement. For FIs, the theme of fintech disruption has evolved to fintech collaboration. When FIs partner with fintech companies, they can modernize legacy infrastructures and bring more innovation to market while at the same time improving the customer experience by engaging their customer base with advanced digital products and services.

- BNPL is not just for retail. BNPL solutions have skyrocketed in popularity in the last year, primarily for e-commerce retail purchases. However, consumers need payment flexibility for critical expenses such as healthcare, home services, and car repairs. Providers of these services need technology partners who can streamline the addition of new payment options into their existing business management software. The large, branded players like Klarna and Affirm are meeting the needs of retailers quite well. Still, there is a lot of room for new BNPL providers to focus on solutions targeted at the specific needs and characteristics of verticals like healthcare.